2025 U.S. Benefits Open Enrollment

Changes for 2025

The following changes will be effective on January 1, 2025, and may require you to make new elections during Open Enrollment:

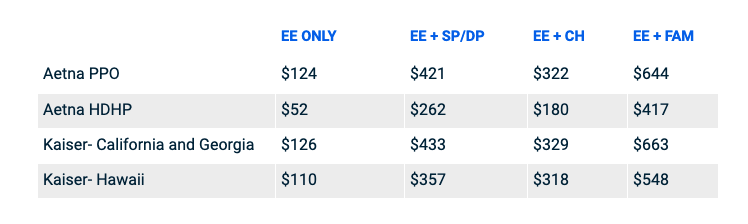

Costs of medical, dental, and vision plan coverage will increase as a result of rising healthcare and prescription drug costs. Samsara will continue to cover the majority of the cost of coverage under all plans—we’ll still pay 85% of the cost of employee medical plan coverage and 70% of the cost of dependent coverage, for example—rather than passing on the full amount of the increases to employees. So while the amount you pay for coverage will increase in 2025, the amount Samsara pays will increase as well. Monthly costs of coverage for 2025 are listed are listed below.

Aetna medical plan annual deductibles will increase. The annual deductible is the amount you pay out-of-pocket before the plan begins paying a portion of eligible expenses.

Aetna High-Deductible Health Plan (HDHP): $3,300 per individual; $6,600 per family (currently $3,200 and $6,400, respectively)

Aetna Preferred Provider Organization (PPO) Plan: $300 per individual; $1,000 per family (currently $250 and $750, respectively)

The Aetna PPO Plan annual out-of-pocket maximums will increase. The annual out-of-pocket maximum is the most you’ll pay for care each year before the plan begins paying 100% of eligible expenses. In 2025, the out-of-pocket maximums will be $3,000 per individual; $5,000 per family (currently $2,250 and $4,500, respectively).

Aetna medical plans will include a travel reimbursement benefit. Samsara’s Medical Travel Reimbursement Policy reimburses eligible expenses for employees and covered dependents who must travel more than 100 miles away from home to receive medical care. A similar benefit will be available through our Aetna medical plans in 2025, so Samsara’s policy will be discontinued on December 31, 2024. If you participate in a Kaiser HMO plan in 2025, your primary care physician will coordinate care that can’t be provided at your local Kaiser facility.

The Kaiser HMO Plan that’s currently available to employees in California will be split into Northern and Southern California plans.

The same healthcare services available to all California Kaiser participants now will continue to be available in 2025, and there will be no changes to the amounts you pay when you receive care.

Beginning January 1, Kaiser participants in Southern California will be able to visit any local Kaiser facility, and will have access to a broader network of primary care physicians (the doctors who manage your care on a day-to-day basis and refer you to specialists in the Kaiser network when necessary).

If you live in California and you enroll in the Kaiser HMO Plan for 2025, you’ll be automatically assigned to the appropriate plan for your location; you don’t need to choose Northern or Southern California when you enroll.

The amounts you can contribute to a Health Savings Account (HSA) are increasing. These accounts allow you to set aside money through pretax payroll contributions for eligible healthcare expenses.

Vision Plan participants will be eligible for new frames every 12 months (currently every 24 months).

The maximum benefits available through our Basic Life and Basic Accidental Death & Dismemberment (AD&D) Insurance Plans are increasing. Samsara automatically provides you with Basic Life and AD&D coverage, which provide a one-time payment to your beneficiary in the event of your death, or to you in the event of a serious accidental injury. In 2025, payments made in the event of your death will be equal to two times your annual salary up to a maximum of $500,000 (currently $250,000). (You have the option to elect additional life insurance coverage for yourself and your family members during Open Enrollment.)

If you enrolled in the ARAG Legal Plan or the Nationwide pet insurance plan when we introduced these two new benefits in June, your elections will roll over automatically to 2025. You can add or remove pet insurance coverage at any time throughout the year, but you can only add or remove ARAG Legal Plan coverage during Open Enrollment (unless you have a qualifying life event). If you’re currently enrolled in the ARAG Legal Plan and you don’t want to participate in 2025, you must actively waive coverage during Open Enrollment.

2025 Benefit Plan Options

Elections You Can Make Only During Open Enrollment

When you complete the Open Enrollment process, you’ll be prompted to select coverage under the plans listed below. Carefully consider your options before enrolling. You can change your elections in 2025 only if you experience a qualifying life event, such as getting married or adding a child to your family. To learn more about any plan, click the section heading.

Medical Plans: Samsara offers up to three medical plan options, depending on where you live. Please review the side-by-side comparison of medical plan benefits for information on your costs of care under each plan.

Aetna Preferred Provider Organization (PPO) Plan–Available to all employees, except those in Hawaii

Aetna High Deductible Health Plan (HDHP)–Available to all employees, except those in Hawaii

Kaiser Permanente Health Maintenance Organization (HMO) Plan–Available to employees in California, Georgia, and Hawaii; plan provisions vary by location

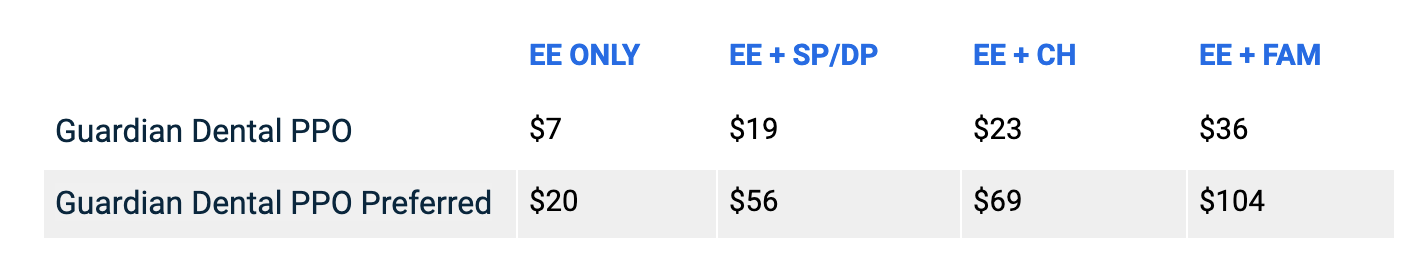

Dental Plans: Samsara offers two dental plan options: the Guardian Dental PPO Plan and the Guardian Dental PPO Preferred Plan. Both plans allow you to visit the provider of your choice whenever you seek care, but your out-of-pocket costs are lower when you visit a provider in each plan’s network. The annual maximum benefit and the lifetime maximum orthodontia benefit are higher under the PPO Preferred Plan, which also covers adult orthodontia.

Vision Plan: Our Vision Plan, which is administered by Guardian, allows you to visit the provider of your choice whenever you seek care, but your out-of-pocket costs are lower when you visit a provider in the Vision Service Plan (VSP) Signature Network. The plan offers discounts on eyeglasses, contacts, LASIK and PRK procedures, and even hearing aids.

Flexible Spending Accounts (FSAs): Healthcare, Limited Purpose, and Dependent Care FSAs allow you to make pretax payroll contributions to savings accounts and submit claims for reimbursement as you incur eligible expenses.

2025 IR Maximum for Healthcare and Limited Purpose FSA: $3,300

2025 IRS Rollover: $660

Dependent Care FSA maximum remains $5,000

ARAG Legal Plan: The ARAG Legal Plan offers access to a network of local attorneys with expertise in estate planning, contract disputes, identity theft resolution, elder law, and more. They can provide advice, review and draft documents, and represent you in court if needed. The UltimateAdvisor Plus™ Legal Insurance plan is $21.90 monthly. Post-Tax Payroll deductions will begin on the first payday after the effective date.

Supplemental / Voluntary Life Insurance Plan: Samsara automatically provides you with Basic Life and AD&D coverage, which provide a one-time payment to your beneficiary in the event of your death, or to you in the event of a serious accidental injury. In 2025, payments made in the event of your death will be equal to two times your annual salary up to a maximum of $500,000 (currently $250,000). (You have the option to elect additional life insurance coverage for yourself and your family members during Open Enrollment.)

Elections You Can Make Anytime Throughout the Year

When you complete the Open Enrollment process, you’ll have the option to contribute to a Health Savings Account (HSA) if you enroll in the Aetna HDHP, and to contribute to our Commuter Benefit Program. You can elect to contribute to these plans during Open Enrollment or anytime throughout the year. You can also stop, increase, or decrease your elections at any time.

Health Savings Account (HSA): Samsara partners with Forma to open HSAs for participants in the Aetna HDHP. Each pay period, Samsara will deposit money in your HSA to help you pay for eligible healthcare expenses, such as medical and dental office visit copays, prescription drugs, and eyeglasses. You can elect to make additional contributions to your HSA through pretax payroll deductions.

Commuter Benefit Program: Samsara’s Commuter Benefit Program allows you to contribute to transit and/or parking savings accounts through pretax payroll deductions. The IRS maximum for 2025 is $325. Any amounts over the IRS maximum will become postax deductions.

Additional Benefits

In addition to the plans outlined above, you’re eligible for all of the following programs and services. You don’t need to elect these benefits during Open Enrollment; they’re available to you whenever you choose to take advantage of them.

401(k) Plan & Financial Planning Services: Samsara’s 401(k) plan includes both traditional and Roth contribution options, as well as a “mega backdoor Roth” after-tax contribution option. Samsara matches 100% of the first 4% of your traditional and Roth contributions, and you own 100% of the matching contribution as soon as it’s deposited in your account. (When you join Samsara, you’re automatically enrolled in the traditional plan at a 1% contribution rate. You can change this rate anytime.) You also have access to financial planning services if you need help setting savings goals, assessing your tolerance for investment risk, selecting investment options, and more.

Basic Life & Accidental Death & Dismemberment Insurance Plans: Samsara provides Basic Life and Accidental Death & Dismemberment (AD&D) Insurance Plan coverage equal to your annual salary (base + bonus/commissions), up to a maximum of $250,000. (Your coverage will increase under both plans to two times your annual salary, up to a maximum of $500,000, beginning January 1, 2025.) Your Basic Life Insurance Plan coverage pays your beneficiary if something happens to you. Your Basic AD&D Insurance Plan coverage pays a benefit to you in the event of your accidental injury, or to your beneficiary in the event of your accidental death. You don’t need to enroll in either plan, but you do need to designate beneficiaries. You can designate any person or entity as your beneficiary for either plan and update your designations at any time in Workday.

Carrot Family Planning: Carrot provides personalized fertility care (testing and diagnosis, egg freezing, in-vitro fertilization, and more) and family-building services for employees who are adopting or having a child through surrogacy. Services are provided regardless of gender, sexual orientation, marital status, or geographic location. The lifetime maximum benefit is $25,000.

Cleo Parenting Support Services: Whether you’re planning a family, new to parenting, or preparing to return to work after a leave, Cleo can help you build confidence in your parenting with the personalized support of a Cleo coach and educational programs. This benefit is available to all parents.

Employee Stock Purchase Plan:The ESPP gives you the opportunity to purchase shares of IOT through after-tax payroll deductions at a 15% discount. That’s a 15% return on your investment when shares are purchased, regardless of the price of IOT at that time. The plan also includes a “lookback provision,” which means your discount might be even more than 15%.

Hootfund: Samsarians receive $150 each fiscal quarter through the Hootfund for use on wellness, professional development, and family and home expenses.

Leaves of Absence: Samsara’s leave of absence policies, which include bereavement leave, jury duty, and parental leave, allow you to take time off work to care for yourself or your family members, or fulfill civic or military responsibilities.

Pet Insurance: Nationwide administers our pet insurance plan. You can choose basic coverage that reimburses you for medical expenses related to accidents and illnesses, or basic coverage plus wellness coverage, which reimburses expenses for annual checkups, vaccinations, and other routine care.

Short- and Long-Term Disability Plans: If you’re unable to work due to an illness or injury, Samsara’s short-term disability plan pays 66.67% of your annual salary, up to $2,500 per week, until you’re able to return to work. If your disability lasts longer than 180 days, our long-term disability plan pays 66.67% of your annual salary, up to $12,000 per month, until your disability ends or you reach age 65, whichever comes first.

Time Off: Samsara offers paid time off through a combination of vacation days, holidays, and the holiday break.

Medical Plan Monthly Costs of Coverage

Dental Plans Monthly Costs of Coverage

Vision Plan Monthly Costs of Coverage

Open Enrollment Checklist

Review the checklist here.

Resources

2025 Open Enrollment: Guide to the Workday Enrollment Process

Alliant (our benefits advocate): samsara@alliant.com or 925-378-6828

Representatives available Monday-Friday 8:30 a.m.-5 p.m. Pacific time

Note: Some of the links on this page go to documents that can only be accessed by Samsara employees.