Disability Coverage

Short-term disability

If you’re sick or injured and unable to work for an extended period, Samsara provides a company-paid short-term disability (STD) benefit.

Here’s how the coverage works:

The benefit provides up to 66.67% of your pre-disability base salary + bonus/commissions.

The benefit becomes effective on the eighth day of a disability due to sickness or injury.

The maximum benefit is $2,500 per week, paid for up to 12 weeks; after this period, you would typically become eligible for the long-term disability benefit.

Your STD benefit may be offset by other benefits received, such as state disability.

Long-term disability

Samsara provides a company-paid long-term disability (LTD) benefit to help replace a portion of your income if you become fully disabled because of sickness or injury.

Here’s how the coverage works:

After a 90 day elimination period, the LTD benefit replaces 66.67% of your monthly pre-disability salary + bonus/commissions.

The maximum benefit is $12,000 per month.

Benefits will continue paying for as long as you remain disabled, until your social security retirement age.

The LTD plan is offset by other benefits received, such as state disability.

You can review the full plan design and benefits here.

Voluntary Disability Insurance (VDI) For California Employees

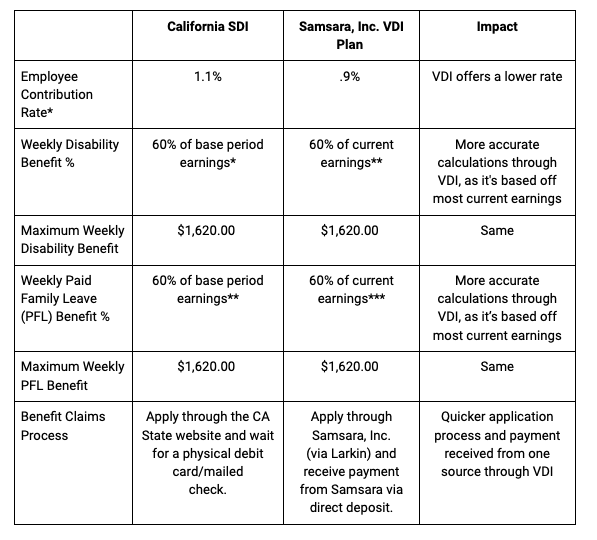

The State of California requires employers to withhold contributions from California employees’ pay to fund coverage under the State Disability Insurance (SDI) Plan. The State allows companies to establish a private plan, called a VDI Plan, and offer it as an alternative to the SDI Plan for California employees. Please find benefit information in the 2025 Voluntary Plan Statement of Coverage (SOC).

The chart below details the difference between SDI and the VDI Plan for the calendar year, 2024.

* Effective January 1, the taxable wage ceiling will be removed in accordance with SB 951 and all California wages will be subject to the 0.9% tax under the VDI Plan or the 1.1% tax under SDI with no set maximum annual contribution amount.

** Base Period Earning Definition: Average pay within past four quarters

*** Current Earnings Definition: Base rate + average bonuses/commissions over previous 12 months preceding the first day of disability

If you would like to opt out of or opt back in to the Samsara VDI plan to contribute to the CA State Disability plan, please follow these steps. Please note that the opt-out will be for the 1st of the next quarter and no money will be refunded.

VDI vs SDI Chart

More Valuable Resources

401(k) Plan

Save for retirement through our 401(k) plan and our 4% company match.

Compensation at Samsara

Your base pay, bonus or commissions, equity grants, and ESPP program

Flexible Spending Accounts

Pre-tax spending account for health care and dependent care expenses.

Health Savings Account

Pre-tax savings account with the HDHP medical plan.

Life Insurance and AD&D

Protect yourself and your loved ones.